Helping companies and

their insurers reduce risk

and costs through a

cloud-based reinstatement cost

data platform

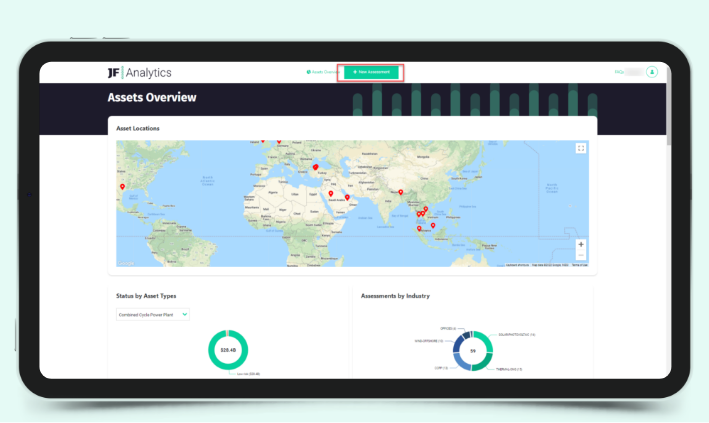

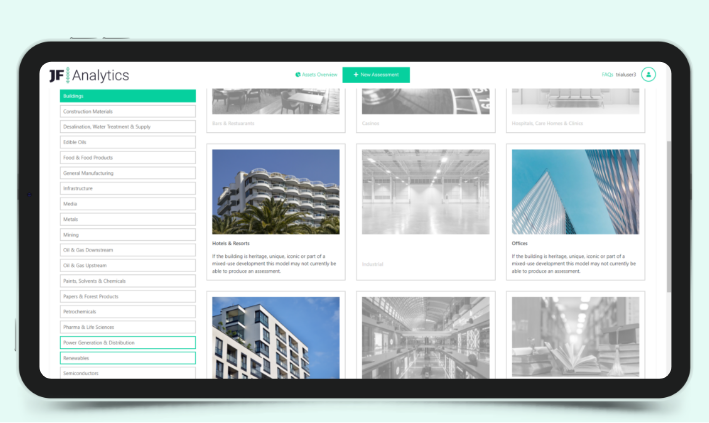

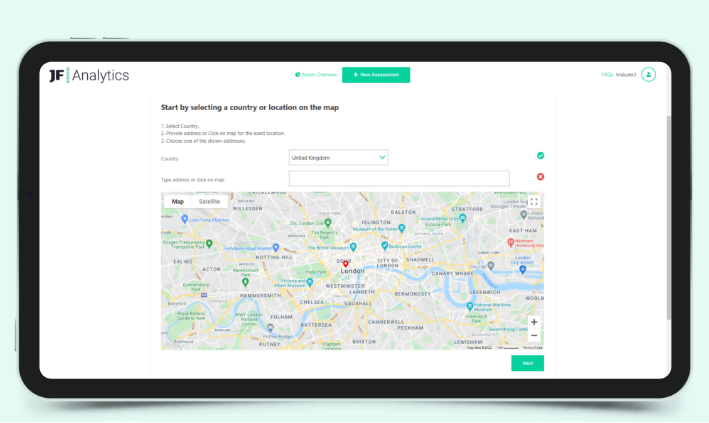

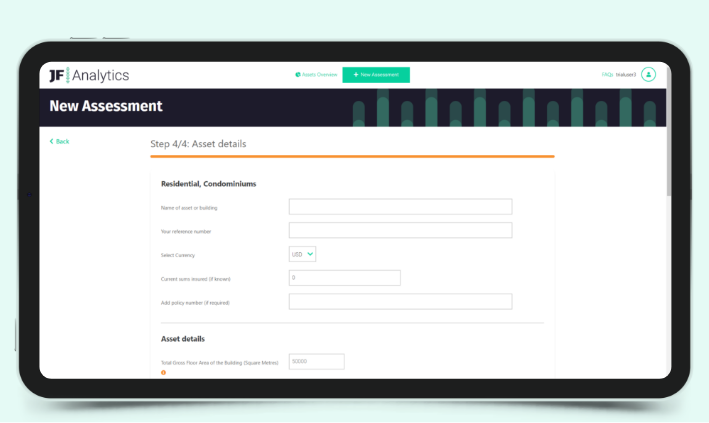

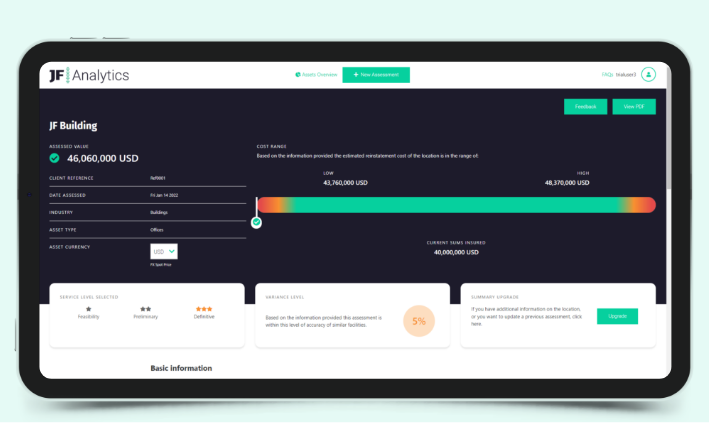

John Foord Analytics is a cloud-based platform giving clients real-time access to reinstatement costs by applying artificial intelligence and machine learning to millions of data points on similar assets.

Developed by John Foord, the leading independent advisory firm specialising in the valuation of commercial and industrial assets, John Foord Analytics leverages decades of asset cost data across thousands of similar assets to generate reinstatement cost estimates via a cloud-based platform.

Asset owners and insurance policy holders, as well as insurers, re-insurers, and brokers can use the platform to quickly ensure sums insured are set correctly and at scale, while using John Foord’s traditional specialists for valuations of more complex assets and structures.

How it works

30

Containing the experience and data of over 30 years of valuations.

24

Available 24 hours a day

on any device,

anywhere in the world.

1st

Asset valuation data available at your fingertips.

Our Solutions

Asset Owners and Risk Managers

Are you struggling to get good information on your assets? Are your sums insured based on historic costs, net book values or guesstimates from internal teams? Are you experiencing increased questions on replacement costs during renewals from insurers or brokers?

John Foord Analytics offers a new solution to clients navigating the complexities of assessing reinstatement costs.

Read more

Brokers and Insurance Advisors

Do you have adequate reliable information on your clients’ assets? Do they really understand the basis behind the declared values at risk? Could you have an issue if your client is subject to average after a claim? Are you facing longer renewal periods with more questions on declared values from insurers?

We understand that building and maintaining a long-term relationship with risk managers and insurers is an essential component to successful broking. Industry and location knowledge is often at the core of those relationships.

Read more

Financiers and Lenders

Are you confident in the loan to value ratios across your portfolio and would understanding current replacement costs give you more comfort on your security?

Are you at risk of under insurance of assets by the borrower putting your loan at increased risk? Do you have adequate information on the assets you have lent against? Can you easily identify assets that could be under or over valued?

John Foord Analytics platform offers financiers and banks an innovative and simple way of validating the information they are being provided with on insurance risks.

Read more

Insurers and Reinsurers

Do you have concerns with the information you are being provided with on values at risk? Is the insured or broker giving you adequate information on the assets? Do you really understand the basis behind the declared values at risk? Can you easily identify under or over insurance?

John Foord Analytics is a newly launched platform that offers insurers a solution to the challenges of defining accurate values at risk.

Read more